33+ Income calculation in us mortgage

Usable income depends on how you get paid and whether you are salaried or self-employed. To get approved youll need.

Greensky Inc 2018 8 K Current Report

Rental Income Calculation Conventional Loan Underwriting 1003 Session 33.

. If your monthly income. Divide this 25000 by the number of months for which youve collected income. 435 53 votes To calculate income for a selfemployed borrower mortgage lenders will typically add the adjusted gross income as shown on the two most.

A debt-to-income ratio below 50 percent. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. To calculate your self-employment income for a mortgage application follow these simple steps.

2019 12 months. To determine your DTI ratio simply take your total debt figure and divide it by your income. A 35 down payment.

An underwriter will calculate your income by taking your current yearly salary and breaking it down to a per-month basis. Use our Home Affordability Calculator to calculate how much income. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

Income Calculation for Mortgages Course now at 6900. Total income across three years 25000. If the new item is an improvement on the old item for example replacing a sofa with a sofa.

The first step to prequalify for a. 2020 12 months. CEO Founder of High-Level Knowledge LLC.

For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent. Were not including additional liabilities in estimating the income. A 20 down payment is ideal to lower your monthly payment avoid.

This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio. Its possible to find an FHA lender willing to approve. This class does not include evaluating self-employed borrowers.

For instance if your debt costs 2000 per month and your monthly income equals 6000 your. A FICO score of at least 580. Hi Im Victoria Martinez.

Most home loans require a down payment of at least 3. For more information or to apply for a mortgage please contact us on 1300 889 743 or complete our today. Analyze your results for stability.

MGIC offers specific Self-Employed Borrower classes for analyzing returns for. Our mortgage income calculator will help you figure out how much home you can afford before applying for a mortgage. If you have a salary of 72000 per year then your usable income for purposes of calculating.

Verify trends of income before using to qualify for a mortgage Income used must be likely to continue Calculating Income 19 See B3-31-01 General Income Information 08072019. 2021 6 months. You will need to provide your most recent pay stub and IRS W-2 forms.

For example if your monthly pre-tax income is. The amount of money you spend upfront to purchase a home. Find your net income from Schedule C on your tax returns for the two most.

Jrfm Free Full Text Optimum Structure Of Corporate Groups Html

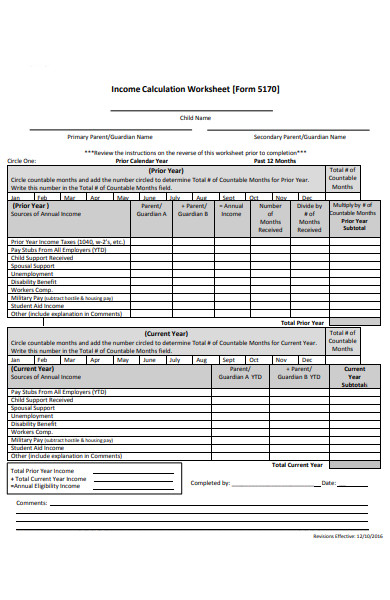

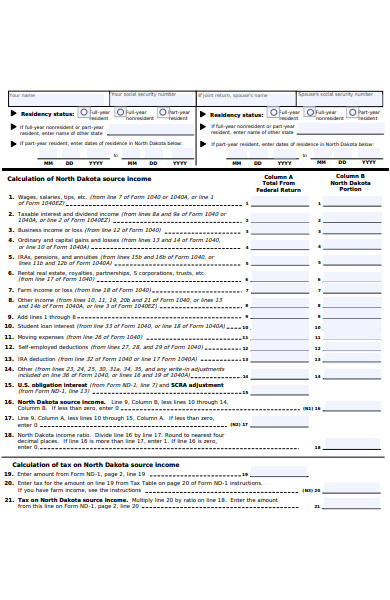

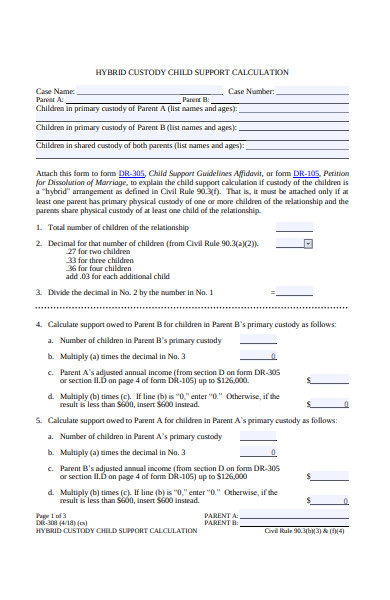

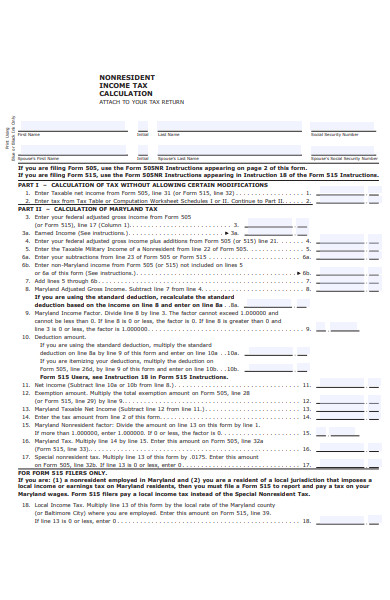

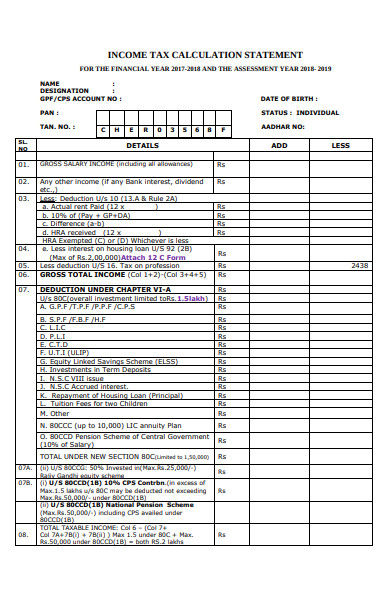

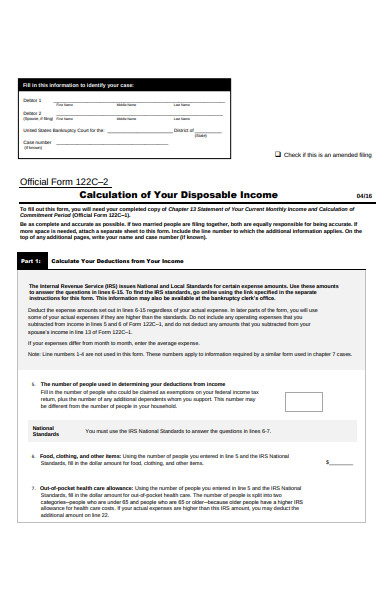

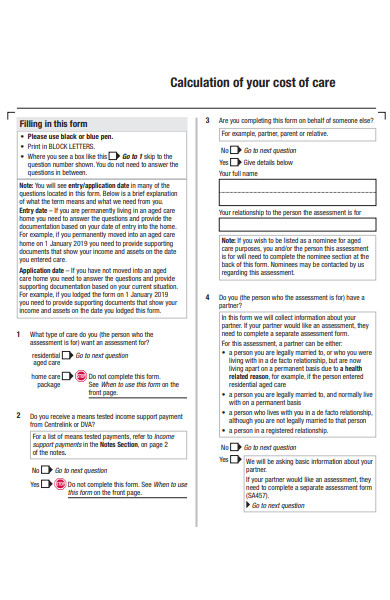

Free 31 Calculation Forms In Pdf Ms Word

Income Tax Act Pdf Ministry Of Justice

Free 31 Calculation Forms In Pdf Ms Word

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Life Planning Printables Spreadsheet Template

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Income Tax Act Pdf Ministry Of Justice

Free 31 Calculation Forms In Pdf Ms Word

Free 31 Calculation Forms In Pdf Ms Word

I 5 1 I 15x The Income Tax Act Ministry Of Justice

Free 31 Calculation Forms In Pdf Ms Word

I 5 1 I 15x The Income Tax Act Ministry Of Justice

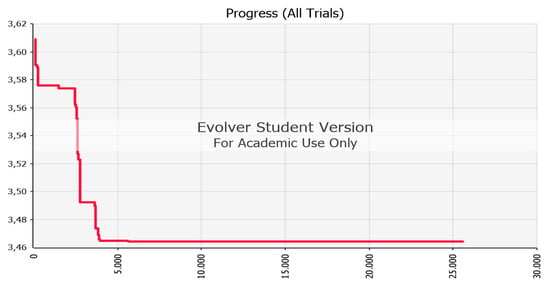

Investor Presentation

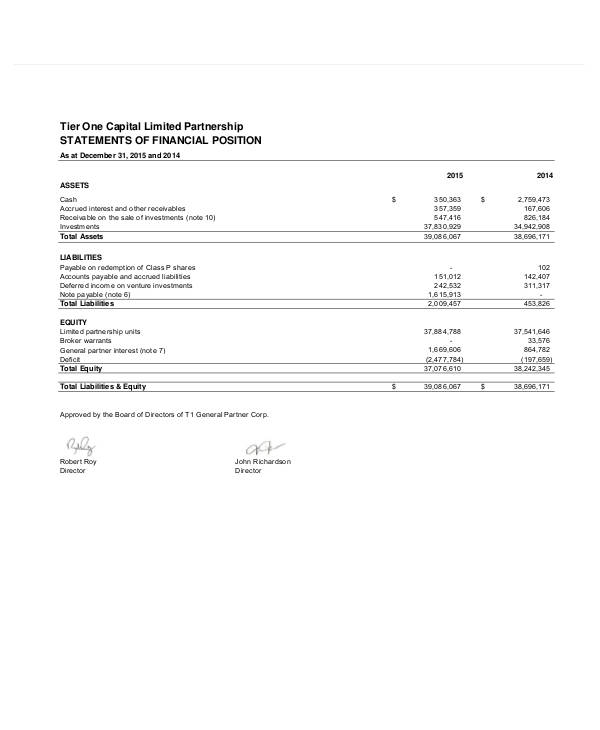

35 Financial Statement Examples Annual Small Business Personal Examples

Free 31 Calculation Forms In Pdf Ms Word

Investor Presentation

Free 31 Calculation Forms In Pdf Ms Word